Leading up to the 21st century, medicines were mostly plants. Small concoctions of herbs and minerals from gardens treated illnesses. Sourcing remedial ingredients was localized; you consulted with family members or town physicians for guidance. It wasn’t until the mid-19th century that experiments began to isolate the active principles in these plants which gave birth to the modern pharmaceutical industry.

Apothecaries turned from botanical distribution to wholesale manufacturing. Ready-made solutions and prepared medicines were sold from local stores with backroom laboratories. Post-WWII, the industry came into its own. Budding Eli Lilly, Squibb, and Pfizer integrated across state lines at the behest of government grants. Outcompeted and under new regulation, regional pharmacies became reliant on national distributors.

Biotechnology seized America in the 1970s. Taking advantage of lowered trade tariffs, companies expanded their technical capacity overseas for active pharmaceutical ingredients (APIs) and raw materials. In 1997, the United States transitioned from a net exporter to an importer of pharmaceuticals. Although the center for biopharma research and development remained in America, manufacturing moved offshore.

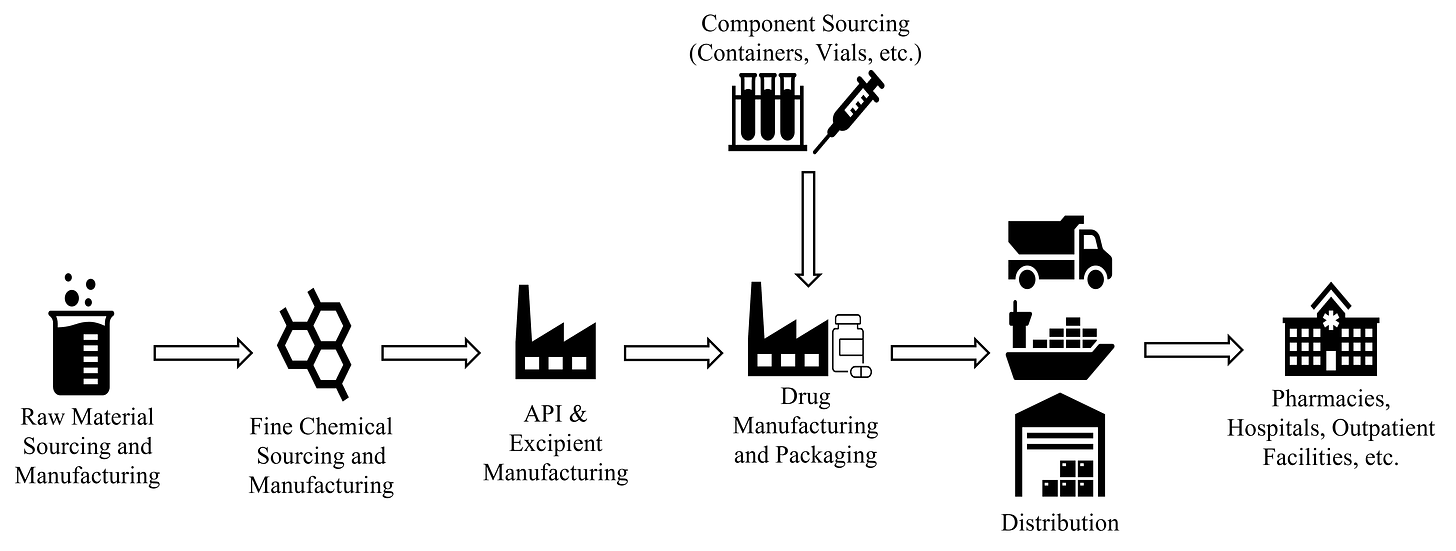

Today, therapies are no longer a local undertaking. Behind each medicine cabinet is a global network unseen by most. A rigid machine extending across nations and continents. What our pharmaceutical supply chain looks like and how its changing is attributable to opaque manufacturing processes, progressive legislation, and evolving technologies.

Raw Materials, Excipients, and APIs

Pharmaceuticals are made with two core elements: APIs and excipients. APIs are the main therapeutic components while excipients are additives to help with delivery and absorption. At their core, both are made from raw materials and chemical compounds. Powders and liquids from plants, animals, minerals, and petrochemicals are fed into synthesis procedures to form the core of our therapies. Consistent with the history of remedial medicines, most active materials used today still derive from plant sources.

APIs are either synthetic or natural. Synthetics used in small molecule drugs like acetaminophen and lisinopril make up most of the market. Much like a cocktail recipe, once you have the correct ingredients for synthetic APIs, the formulation process isn’t incredibly difficult. Convert the raw materials, solvents, reagents, and catalysts through a series of processing procedures until you’ve created the compound. Synthetic formulation is a straightforward process compared to naturals used in biologic drugs.

Biologics (large proteins, antisense RNA, human blood products, and gene and cell therapies) use living cells to treat diseases. Construction involves the production, extraction, fermentation, and bioprocessing of cells and bodily fluids from patients themselves. As a result, natural APIs add high degrees of purity and process controls to the manufacturing process. Timeframes vary from several days to months at a time because of the complexities. Natural API formulation, and furthermore biologics, are more like wine than cocktails. You may have the right ingredients, but the intricacy and moving parts make production varied and complicated.

Historically, making APIs and excipients was done onshore. Manufacturers now take advantage of low-cost labor, factories, and limited environmental liabilities offshore. First in Puerto Rico, then Europe, and now India and China. In 2021, 73% of FDA-registered API manufacturing facilities were foreign with the EU, India, and China making up 25%, 19%, and 13% of our supply.1

For domestic sites, the FDA evaluates the selection and control of raw materials that go into APIs. For overseas facilities, manufacturers regularly undergo FDA safety audits. Unfortunately, the inspection of raw materials and fine chemicals that go into foreign API manufacturers is often outside of the FDA’s purview, specifically for generics. It also doesn’t help that drug manufacturers may use varying raw material sources and APIs across different finished products. As a result, volume is increasingly difficult to calculate, and traceability is nearly impossible.1 The lack of transparency and complex production web becomes a massive health hazard in the case of illicit materials. Unchecked materials may lead to compromised drugs. It’s estimated 1% of medicines available in the west are likely to be counterfeit and 11% in developing nations.2 Counterfeit medicines are an imminent concern amongst the FDA, doctors, and patients alike.

Once APIs and excipients are produced, they’re shipped to facilities that assemble the finished drug products and prepare them for distribution.

Manufacturing and Packaging

Manufacturing involves mixing APIs and excipients to construct the drug’s final form. Processes differ based on the type of therapeutic and are dependent on particle size, polymorphism, pH, and solubility. There are three general types of drug forms: enteral (drugs absorbed through the gastrointestinal tract and are typically tablets and capsules for oral consumption or sustained released), parenteral (drugs administered outside of the gastrointestinal tract such as liquids and lyophilized for intravenous, intramuscular, and intra-articular administration), and topical (creams, gels, and ointments for cutaneous administration). Depending on the production volume, manufacturing might be done in-house for larger pharmaceutical companies or outsourced to contract manufacturing organizations (CMOs).

For enteral drugs, manufacturing generally looks the same: wet granulation, dry granulation, or direct compression. The choice of formulation depends on the API’s compression properties, physical and chemical stability, particle size, availability of equipment, and estimated cost. Once all materials are gathered, they’re weighed, milled, mixed, compressed, and lubricated until the final tablets are procured. Compared to biologics, the final formulation sequence, as is the same with APIs, is direct.

Yeast, bacterial, viral, or mammalian cells are involved in the production of biologics. For them to work, raw materials are obtained from either the patient or other organisms, modified, and then reinjected to trigger a therapeutic response. Because living creatures are used, biomanufacturing is intricate, time-consuming, and requires significant upfront capital. Most biologics today are produced in the following steps:

A gene encoding a desired molecule/protein is inserted into a production cell.

The production cell multiplies and produces the desired molecule/protein

The molecules/proteins are isolated and purified from the cells and other impurities

The purified molecules/proteins, now the APIs, are formulated into the drug product

The steps above are a generalization and vary based on the type and nature of the protein produced, the target, and the administration process. To make biologics at scale, a production cell line (cell cultures used to produce the protein or molecule) and a master cell bank are developed to supply genetically identical cells for future products.

To create a cell bank, the production cell line is transferred to a bioreactor (a container filled with a growth medium, a nutrient-rich consommé, kept at optimal temperature, pH, and oxygen concentration). Cells in the bioreactor are allowed to multiply for a few generations. They’re then collected and divided into small vials which are frozen to stop cell growth. From these vials, APIs are isolated and manufactured into final drugs.

For both small molecules and biologics, manufacturing processes are mostly done overseas. 52% of all FDA-regulated drug manufacturing facilities are located outside of the United States. Most sites are in India and the EU making up 26% and 16% of our imported pharmaceuticals. Of these foreign facilities, 87% of them produce APIs for our generic drugs.

Manufacturers typically operate using a just-in-time approach to keep costs low. Products are first made to meet demand, not in advance of need. Holding slim inventories keeps costs low when trade flows are smooth but results in issues with rapid changes in demand. We saw this during COVID with PPE and vaccine shortages. As our overseas manufacturing reliance increases, supply liability becomes a looming concern.

On top of supply issues, offshore production is often a problem when branded drugs go generic. Biopharmas run troubleshooting tests at every step of the manufacturing process to make sure branded drugs are high quality and sound. Companies selling new, brand-name drugs have strong incentives to maximize profits, especially when it comes to convincing doctors that they’re effective. As a result, every step of the production process is carefully monitored and controlled. For generic manufacturers competing on price, to save money, corners are sometimes cut changing the traditional manufacturing recipes or using impure materials. When these impurities show up in FDA screenings, recalls, illnesses, and sometimes deadly results.3

According to the FDA, about 370 drugs have been recalled or issued safety alerts since 2017. Of these, almost 25% were related to API manufacturing impurities or undeclared substances. A recent problem testing labs have been running into is N-Nitrosodimethylamine (NDMA), a highly hepatotoxic compound and group 2a carcinogen, and other N-nitrosamine contaminants appearing in drugs. In 2018, the API valsartan, an angiotensin II receptor blocker (ARB) used to treat high blood pressure, was recalled due to high NDMA levels. Following valsartan, similar heartburn medications irbesartan, losartan, ranitidine, and nizatidine were also recalled due to NDMA.4

Investigations resulted in Zhejiang Huahai Pharmaceuticals (ZHP) of China and Hetero Labs of India being named culprits. The cause of the problem was a solvent change in the API production process with ZHP introducing a cheaper, higher-yielding manufacturing route around 2012. Following ZHP, other manufacturers then developed their own variations on the route resulting in similar defects. The FDA didn’t catch the change for six years. Although no serious problems occurred with these recalls, the fact that they happen is a problem.5 To curb these occurrences, legislation aimed at strengthening our visibility and security in the supply chain continues to be enacted.

The Drug Supply Chain Security Act (DSCSA) aims to improve transparency and safety for sourcing. It outlines a system of electronic traceability at the package level for pharmaceutical products distributed in the United States, enabling the FDA to better safeguard consumers against counterfeit, stolen, contaminated, or otherwise harmful drugs. Due to concerns over foreign manufacturing and resiliency, Executive Order 14017 attempts to strengthen America’s supply chain by investing in domestic manufacturing and enhancing the security of imported goods and materials. This legislation also aims to increase the traceability of our pharmaceuticals. As a result, entities selling into the United States are required to have FDA-labeled identifiers on all packing in hopes of reducing errors and authenticity.

Already a meticulous process, pharmaceutical packaging is separated into three steps: primary, secondary, and tertiary processes. Primary packaging includes storage in sterilized container closure systems (blisters, bottles, ampoules, prefilled syringes, and cartridges) where drugs are preserved as solids, liquids, or gasses. Secondary packaging places pharmaceuticals into required outer shells containing printed data, branding, and other inserts. Pharmaceuticals then undergo tertiary packaging where they’re boxed and shrink-wrapped to ensure safe shipment. Once boxed and labeled, packaged pharmaceuticals are ready to be transported.

Distribution

Packaged therapies are assessed, purchased, and distributed directly to retailers, or to Group Purchasing Organizations (GPOs) which negotiate on behalf of health systems. About 90% of pharmaceuticals are propagated by primary wholesalers like McKesson and AmerisourceBergen through a network of ships, trains, and trucks. 3PLs work in tandem to organize and consolidate prescriptions at regional depots before they arrive at your local pharmacy. Once totes are bundled with a mix of products, they’re then trucked to retailers to be dispensed.

Distributors ensure medicines are available to meet patient demand and adhere to state and federal regulations. As a result, low temperature-controlled storage and logistics systems, called cold chains, are integrated throughout the supply chain so medicines don’t denature, and excursions occur. Cold chains made the news through COVID due to the vaccines’ fragility (-80°C and -60°C storage requirements to remain effective). Stringent temperature demands are becoming increasingly mandated as biologics growth outpaces small molecules. Cell therapies grew 301% compared to small molecules’ -6.5% from 2017 through 2021. With this increase, refrigeration trucks and monitoring devices are increasingly used and integrated into supply chain management software.

Software companies like FourKites, Project44, Chain.io, and Optimal Dynamics have amassed enormous amounts of capital from VCs to increase visibility, transportation management, system interoperability, and logistics optimization across our supply chains. These platforms ameliorate the friction of our current systems and attempt to create what we need: a digital twin that learns the push and pull of supply and demand. On top of these advances, last-mile delivery companies reducing distribution friction are also focusing on pharmaceuticals.

Conventional pharmacies and health systems rely on patients physically picking up their prescriptions or receiving treatment. A not-so-recent alternative is the development of direct-to-patient delivery (DTP, also called direct-to-consumer or DTC). Mail-order pharmacies, beginning in the 50s, were the first iteration where eligible veterans receive their pharmacy orders at their door via the VA. Thanks to the internet, pharmaceuticals are now accessible on smartphones where startups like Ro charm the chronically online through a deluge of pastel-branded ads.

DTP is only obtainable if fulfillment operates congruently. Curexa, Omnicare, and PillPack (now Amazon Pharmacy) provide national services and distribution capabilities. Regional players like Alto and Capsule have created market wedges attributable to underserved patients (Diamond exclusively services correctional facilities). With the expansion of fulfillment options, DTP has become an expectation rather than a luxury.

Most DTP therapeutic offerings are erectile dysfunction, birth control, and migraine solutions: posing minimal risk to the patient and are administered quickly. In March 2020, the Ryan Haight Act, which previously required an in-person examination to prescribe controlled substances, was suspended. Although the change has allowed telehealth providers to service previously unreachable patients, it also creates room for potentially unsafe prescription practices. DTP startup Cerebral and supplier Truepill have faced the brunt of this campaign with ongoing investigations about allegations of predatory marketing on TikTok and unlawful fulfillment practices.

For biologics requiring diagnostics and/or unique administration, DTP operates differently. Decentralized trials now allow clinical materials and investigational medicinal products to be distributed to and administered at patient homes with the help of a practitioner. Payors require clinicians to manage these processes because of the complicated nature of the therapies. Currently, DTP biologics don’t operate at the scale of small-molecule drugs. Not to say you won’t be able to give yourself CAR-T therapy one day, but it’s a substantial liability both to you and payor alike.

Promising convenience and accessibility, DTP has molded consumers’ expectations about how and when they receive their pills. This attitude becomes an issue when sourcing, manufacturing, and distribution can’t keep up. Unfortunately, rapid changes in demand cause deficiency resulting in drug delays, untreated patients, and prolonged illnesses. We’re now seeing this with Adderall where over-prescribing has backed up production causing the ongoing shortage.

Parting Thoughts

The logistics behind your neatly packaged SSRIs isn’t some obedient instrument. The facilities, warehouses, and shipping channels that control our pharmaceutical supply chain suffer from a lack of raw material transparency, questionable generics production, and supply/demand inflexibility.

Given the scale of the industry, the FDA has done a remarkable job of setting quality standards and tracking medicines. On top of existing infrastructure, recent legislation and new technologies aim to push for clarity and heightened safety measures. Product movements are progressively traced for all FDA-registered companies involved in the US. A budding startup ecosystem focusing on reducing friction through DTP distribution, visibility, and interoperability gives companies stronger tools to service patients.

Our pharmaceutical supply chain is evolving. No longer do we rely on town apothecaries to provide us our remedies. Instead, we look to international conglomerates that produce, procure, and deliver our treatments. With so much at stake, it's important to ask ourselves: is this the best we can do?

Opinions are my own and do not reflect the views of my employer. Thank you to Denis, Ina, and Matt S. for your thoughts and feedback.

“Building Resilient Supply Chains, Revitalizing American Manufacturing, and Fostering Broad-Based Growth.” The White House, June 2021, pg. 216

“Substandard and falsified medical products.” World Health Organization, January 2018.

“It’s time to bring generic drug manufacturing back to the U.S.” STAT News, June 2020.

“NDMA, a contaminant found in multiple drugs, has industry seeking sources and solutions.” Chemical and Engineering News, April 2020.

“The Sartan Contamination Story.” Science, January 2019.

Quite an informative read!

I was curious if you write in areas relating to health and tech around the world besides US specific writings.